Understanding Network Hospitals in Health Insurance: Types, Limitations and Benefits

What is OPD Coverage? How to get Comprehensive Healthcare Benefits for your employees

Introduction to OPD Coverage In today’s competitive business environment, providing comprehensive healthcare benefits for employees is essential. One key aspect of these benefits is Outpatient Department (OPD) coverage. OPD coverage allows employees to access healthcare services without being admitted to a hospital, covering various medical needs from consultations to minor treatments. The Importance of Comprehensive Healthcare Benefits Offering OPD coverage as part of your employee healthcare benefits is not just a cost-saving measure; it significantly contributes to overall employee satisfaction and well-being. When employees can visit doctors for check-ups and treatment without worrying about exorbitant costs, they feel valued and supported. This support can lead to increased productivity and lower absenteeism rates. How to Access OPD Coverage for Employees Obtaining comprehensive OPD coverage is relatively straightforward. Employers can approach insurance providers to explore various health plans that include OPD services. Factors to consider when selecting a plan include the network of hospitals, the range of covered services, and any caps on expenses. Additionally, consider integrating wellness programs that promote preventive health measures to enhance the benefits package further. In summary, incorporating OPD coverage into your employee benefits strategy is a vital step toward fostering a healthier workforce. By ensuring your employees have access to necessary medical services, you not only enhance their health outcomes but also strengthen their loyalty and commitment to your organization.

What is External Congenital Cover? Ensure the best health cover for your employees

What is External Congenital Cover? External congenital cover refers to a specific type of health insurance that encompasses expenses related to congenital conditions that are not typically included in standard health plans. These conditions, which may be present from birth, require comprehensive coverage to facilitate proper management and treatment. For businesses aiming to provide the best health cover for their employees, understanding this type of coverage is essential. The Importance of External Congenital Cover Employers should recognize that offering robust health insurance options, including external congenital cover, significantly contributes to employee satisfaction and retention. This coverage is particularly crucial for employees who might have dependents with congenital conditions, providing them with peace of mind regarding their healthcare costs. Moreover, having comprehensive health coverage can enhance workplace productivity, as employees can focus on their work rather than worrying about medical bills. How to Choose the Best Health Cover When selecting a health plan that includes external congenital cover, employers should evaluate the specific needs of their workforce. Consider factors such as the range of conditions covered, the network of specialists available, and the policy’s overall flexibility. It is advisable to consult with health insurance experts or brokers who can guide you in identifying plans that offer comprehensive benefits, including external congenital cover, tailored to your employees’ needs.

Your beginner’s guide to making smart money moves.

Understanding the Basics of Investing Investing is a critical aspect of personal finance and wealth creation. At its core, investing involves allocating resources, typically money, in order to generate a profitable return over time. This distinguishes it from saving, which generally implies setting aside money for future use without the expectation of earning a return. A fundamental understanding of key investment concepts is essential for anyone embarking on an investment journey. Among the primary financial instruments in investing are stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Stocks represent ownership shares in a company, and when investors buy stocks, they are purchasing a stake in the company’s future earnings. Bonds, on the other hand, are essentially loans made by investors to corporations or governments, whereby the issuer pays back the principal along with interest over time. Mutual funds and ETFs combine the investments of multiple individuals to pool capital for the purpose of purchasing diversified portfolios of these stocks and bonds, providing an easier way for novice investors to gain exposure to varied asset classes. Understanding the relationship between risk and return is crucial in investing. Higher potential returns generally come with higher risks. Therefore, recognizing one’s risk tolerance is necessary to build a suitable investment strategy. Asset allocation, the method of dividing investments among different asset categories, further helps manage risk. Diversification within asset allocation minimizes exposure to a single asset’s poor performance. Finally, the concept of the time value of money is vital. This principle asserts that money available today is worth more than the same amount in the future, due to its potential earning capacity. Through incorporating these essential concepts, beginners can build a robust foundation in investing. This knowledge will serve as a guiding framework as they explore specific investment opportunities and strategies, ultimately contributing to their financial success. Setting Financial Goals for Successful Investing Establishing financial goals is a crucial first step for anyone embarking on the journey of investing. Clear and achievable goals serve as a roadmap, guiding investment strategies and ensuring that the investor remains focused on their desired financial outcomes. It is essential to distinguish between short-term and long-term goals, as each will have different implications for investment choices and strategies. Short-term goals might include saving for a vacation or building an emergency fund, whereas long-term goals often encompass retirement savings or funding education for future generations. As investors consider their financial aspirations, assessing individual risk tolerance becomes imperative. Risk tolerance refers to an investor’s ability and willingness to endure fluctuations in the value of their investments. This self-assessment enables one to align investment strategies with financial capabilities and emotional comfort levels. Various tools and questionnaires are available to help individuals understand their risk tolerance, which can subsequently influence the types of assets they choose to invest in. A conservative investor may prefer bonds and low-volatility stocks, while an aggressive investor might lean towards high-growth equities. Creating a realistic investment timeline is another essential step in setting financial goals. By establishing a specific time frame for achieving each goal, investors can better determine the appropriate investment strategy and asset allocation. For instance, a goal that is ten years away may justify a more aggressive investment approach, whereas a goal within a couple of years may require a more conservative stance to preserve capital. Aligning investment choices with personal financial objectives ensures a cohesive strategy, fostering a sense of purpose and commitment. In summary, laying a solid groundwork in financial goal setting not only enhances investment decisions but ultimately drives long-term success in wealth accumulation. Choosing the Right Investment Strategy When it comes to investing, selecting the appropriate strategy is paramount to achieving financial goals. For beginners, understanding the various investment strategies available can illuminate the path to smart money moves. Three common strategies include passive investing, value investing, and growth investing, each with its unique attributes and considerations. Passive investing primarily involves buying and holding investments over a long period, typically through index funds or exchange-traded funds (ETFs). This approach capitalizes on market growth, minimizing the need for frequent trading and reducing associated costs. Its advantages include lower fees and reduced stress for investors who prefer a hands-off approach. However, it may not be suitable for those seeking rapid gains in volatile markets, as passive investments generally reflect market averages. Value investing, on the other hand, focuses on identifying undervalued stocks that are currently trading below their intrinsic value. This strategy requires diligent market research and analysis, making it more time-intensive. Successful value investors can potentially reap substantial rewards, as they buy low with the expectation of future appreciation. Nevertheless, the risk lies in the possibility that the perceived undervaluation may not rectify itself, leading to prolonged holding periods without gains. Growth investing centers on companies expected to grow at an above-average rate compared to their industry or the overall market. Investors benefit from price appreciation rather than dividend payouts, as these companies often reinvest earnings to fuel expansion. While the potential for high returns is appealing, investors must also be mindful of the risks, including volatility and high valuations, which can lead to significant losses if market conditions change. Regardless of the chosen investment strategy, diversification remains crucial. Spreading investments across different asset classes can mitigate risk and improve returns over the long term. Additionally, conducting thorough market research is essential in selecting a strategy that aligns with personal financial goals and risk tolerance. By understanding these fundamental strategies, beginners can make informed decisions and embark on a successful investing journey. Navigating the Investment Market: Tools and Resources Embarking on the investment journey requires not only initial capital but also the right tools and resources to navigate the complexities of the financial markets. Among the foundational elements are the types of investment accounts available to beginners. A brokerage account, which allows individuals to buy and sell assets such as stocks and bonds, is essential. Additionally, retirement accounts—such as Individual Retirement Accounts (IRAs) and 401(k)s—can offer significant tax advantages while investing

What is eNPS? Why does it matter?

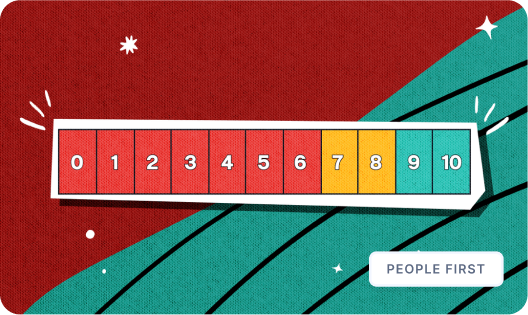

What is eNPS? Employee Net Promoter Score (eNPS) is a metric used to gauge employee engagement and loyalty within an organization. It is derived from the traditional Net Promoter Score (NPS), originally designed to measure customer satisfaction. The eNPS focuses on employees, asking them a simple question: “On a scale of 0 to 10, how likely are you to recommend our company as a place to work?” Based on the responses, employees are categorized into promoters, passives, and detractors, which helps organizations understand the overall sentiment towards their workplace. Why Does eNPS Matter? The significance of eNPS lies in its ability to provide insights into employee sentiment and engagement levels. High eNPS scores usually indicate a workplace where employees are satisfied, engaged, and likely to recommend the organization to potential job seekers. This metric can be a valuable tool for identifying areas of improvement and enhancing employee retention, thereby minimizing turnover costs. Utilizing eNPS Effectively To leverage eNPS effectively, organizations should conduct regular surveys, allowing for real-time feedback from employees. Analyzing trends over time can help management understand the impact of workplace initiatives and policies. Furthermore, creating an action plan based on feedback can foster a culture of communication and transparency, ultimately leading to increased employee loyalty and satisfaction.